Get EXPERT HELP from The Reverse Mortgage Pros

Discover the Benefits of a Reverse Mortgage in 2025 Learn MoreCall the California Reverse Mortgage Pros

Wendy: (408) 209-5569 (on left)

Edith: (408) 313-6162 (on right)

Meet Your CALIFORNIA Mortgage team

Wendy Wong &

Edith Van Bijlevelt

Proactive. Professional. Personable.

Now you can rely on the mortgage team that provides more than 60 years combined expertise helping homeowners in the SF Bay Area / Silicon Valley and throughout California. Whether you’re looking to stay in your home—or help your relatives stay in theirs—we’re here to help you every step of the way!

live in your CALIFORNiA home with confidence

Top 14 Reasons Why Homeowners Are Choosing Reverse Mortgages in 2025

- No monthly mortgage payments required

- Cash-out for any purpose (emergency healthcare needs, normal living expenses, home maintenance/insurance/property taxes, vacation/travel, anything!

- No minimum credit scores to qualify

- You can never be forced out of your home (as long as you pay property taxes and homeowners insurance)

- Social security and Medicare income is not affected

- Homeowner can never “outlive” loan regardless of proceeds when one dies/sells home (Heirs are never personally liable for more than the value of the home.)

- Loan proceeds are not taxable

- Flexible loan terms (lump sum, annuity, equity line of credit, or combination

- Pays off existing mortgage (Home does not have to be mortgage free at the time of taking the reverse mortgage.)

- Can be used to supplement income when investments are losing money, so you don’t have to use the principal from your investments

- (Financial planning tool) helps extend your retirement assets (IRA’s, 401K’s, annuities, etc.)

- Available credit from reverse mortgage goes up as home value increases

- Access home equity as needed (pull funds from available credit, and do not use if not needed)

As experienced mortgage brokers, we know how important it is to help individuals and families buy and stay in the home they love. We’re privileged to have helped thousands of people across California—and we’re here to help you, too.

–Wendy and Edith

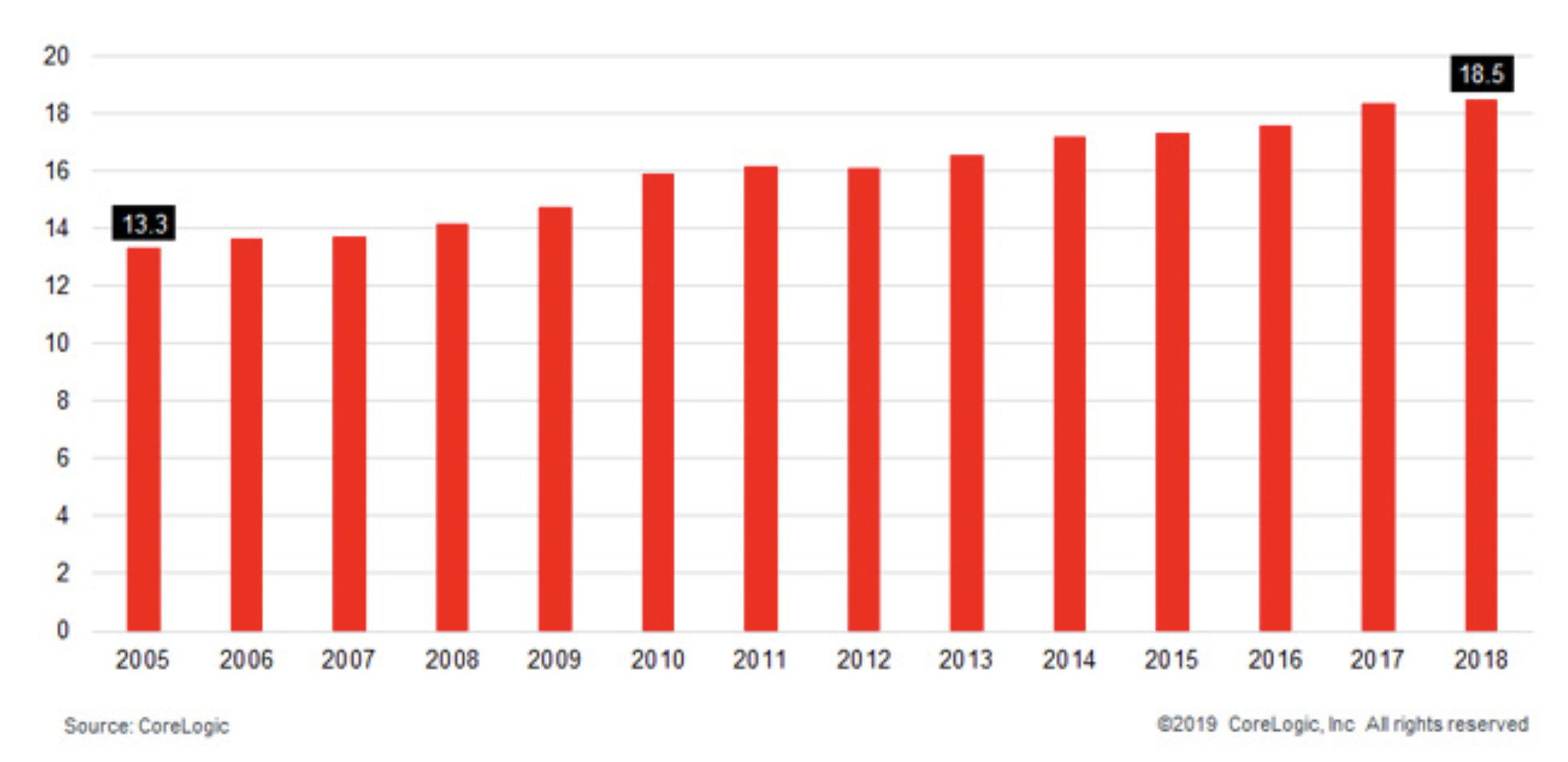

IT’S A U.S. HOUSING FACT:

The number of years that a borrower owns a home are consistently on the rise.

Did you know? Borrowers owned a home for an average of 18 years? That's up 5 years from 2005.

Additional Mortgage Services for Californians

What We Can Do For You

Reverse Mortgage Ready also provides a wide range of service beyond reverse mortgages. We’re experts in helping California homebuyers get pre-qualified and ready to buy a home, homeowners benefit from home loans that are customized to their needs. We help homeowners lower their interest rates, use the equity in their homes for home improvements, debt consolidation, children’s college expenses and more.

Contact us today.

To contact Wendy and Edith, please email us at [email protected]. We’re always ready to help!

Reverse Mortgages

Great for seniors who have equity and want to improve their quality of life while remaining in their home.

Purchase

Home Improvement loans

Cash Out Loans

Get In Touch

We’re Your Team

EDITH Van BIJLEVELT

Senior Loan Consultant

(408) 313-6162

NMLS #336511/CA DRE #01110387

WENDY WONG

Senior Loan Consultant

(408) 209-5569

NMLS #336343/CA DRE #01030645

call us today